1Introduction

This manual explains the installation, configuration and usage of the payment module for PrestaShop and Saferpay.

Before beginning with the installation, please make sure that you are in possession of all necessary data:

- You should have received a username and a password from Saferpay

- PrestaShop payment module by sellxed.com/shop

- Access data to your server and shop

In case you don't yet have a contract with Saferpay, you can gladly acquire it directly through us.

Note that you must use at least PHP version 5.6 for our plugins. PHP 8 or higher is currently not supported.

1.1Installation Procedure

In this document you will find all important information for the installation of the module. It is important that you strictly follow the checklist. Only by doing so, the secure usage in correspondence with all security regulations is guaranteed.

- Configuration of the basic settings of the payment module

- Configuration of the payment methods

- Conducting a test purchase

- Activate your account with Saferpay

Our payment plugins should have per default the correct settings for most of our customers' preferences. That means once you have entered the required credentials in the plugin configuration to connect your account to your website, the plugin should be fully operational. Should you be willing to receive detailed information on a setting you do not know, you may contact our support team who will be able to assist you further.

Our support team is at your disposal during regular business hours at: http://www.sellxed.com/support. Furthermore, you have the option of ordering our installation service. We will make sure the plugin is installed correctly in your shop: http://www.sellxed.com/shop/de/integration-und-installation.html

In order to test the module, any kind of directory protection or IP blocking on your server must be deactivated. This is crucial as otherwise the payment feedback of Saferpay might not get through to the shop.

1.2System Requirements

In general, the plugin has the same system requirements as PrestaShop. Below you can find the most important requirements of the plugin:- PHP Version: 5.4.x or higher

- PrestaShop Version: 1.6.x or higher

- OpenSSL: Current version with support for TLS 1.2 or higher.

- fsockopen: The PHP function fsockopen must be enabled. The plugin must be able to connect to external systems over the Internet.

- PHP Functions: All common PHP functions must be enabled.

2Configuration Saferpay

2.1Migrating to JSON API

Please note that the old interface will be replaced by the new JSON API. In order for us to guarantee the long-term use of the module we have changed all of the modules to the JSON API. This has been tested extensively. The following steps are imperative to guarantee a continued smooth functioning of the payment module.

From now on only JSON API will be available and you need to follow these next steps carefully otherwise the plugin will not function properly. All orders that have already been authorized can still be canceled or refunded.

Due to the changes to the PCI Standard the hidden mode will no longer be available.The authorization will now take place via the new JSON API Payment Pages. In case you used the hidden mode you need to save the settings of your payment methods in your shop again after the migration or deactivate the payment method and activate it again.

Follow each step of the checklist carefully and make the necessary changes. (Each step is clarified by a screenshot further below.)

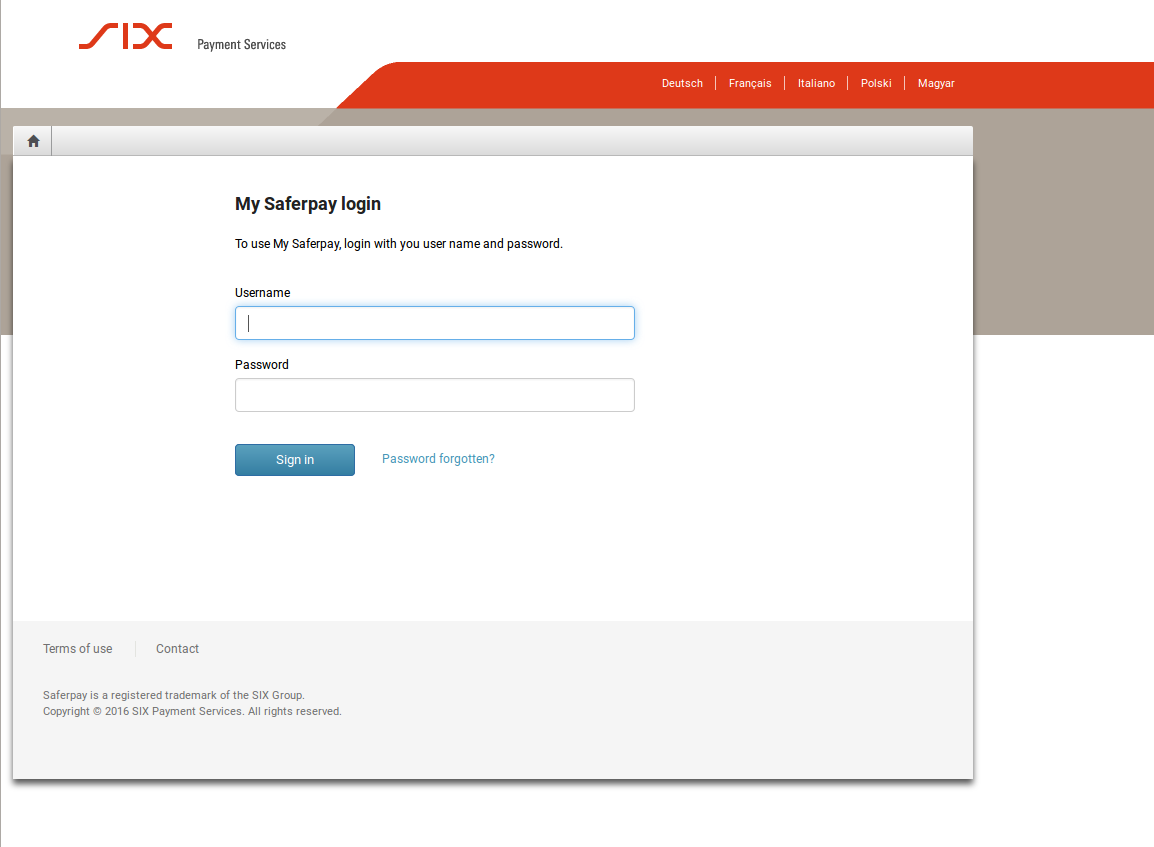

- Go to https://www.saferpay.com and log in with your username and password. On the right hand side you will find a dropdown. Chose Saferpay E-Payment and you will be directed to the backend of MySaferpay. (https://www.saferpay.com/BO/Login/).

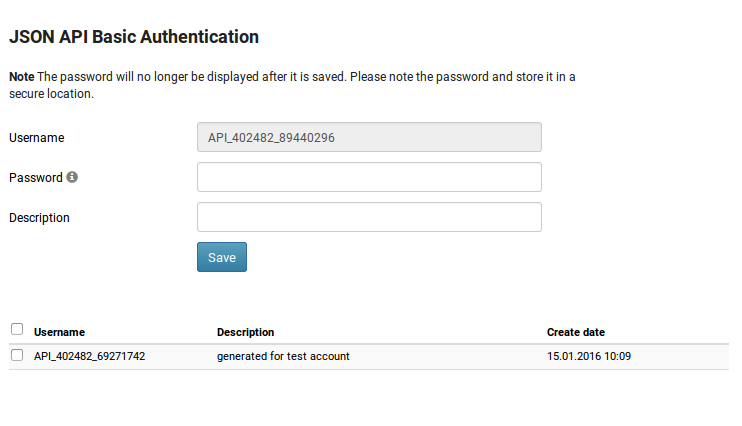

- The access data for the JSON API can be created via Administration > JSON API. Here you can chose a password. The user will be generated automatically.

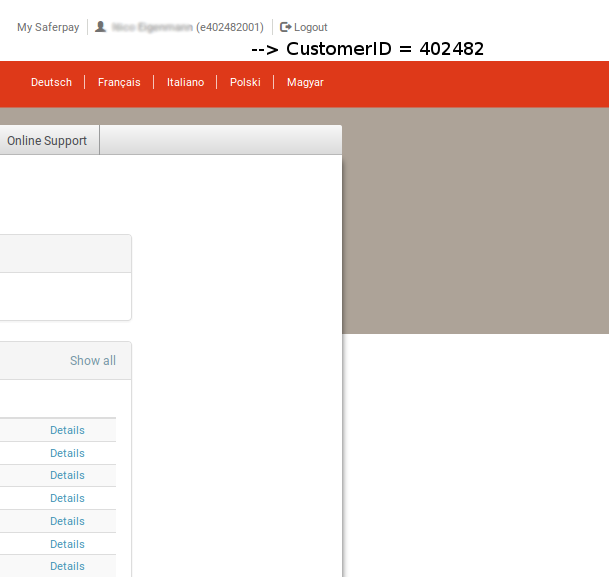

- You will also need a Customer ID. You will find this at the top right. Next to your username there is a number in brackets. ()It looks like this: e402487002). Your Live Customer ID consists of this number. Simply leave away the e and the last three digits and you will receive your Customer ID. It consists of six digits. In the example above your Customer ID would be 402487. (Compare with screenshot further below)

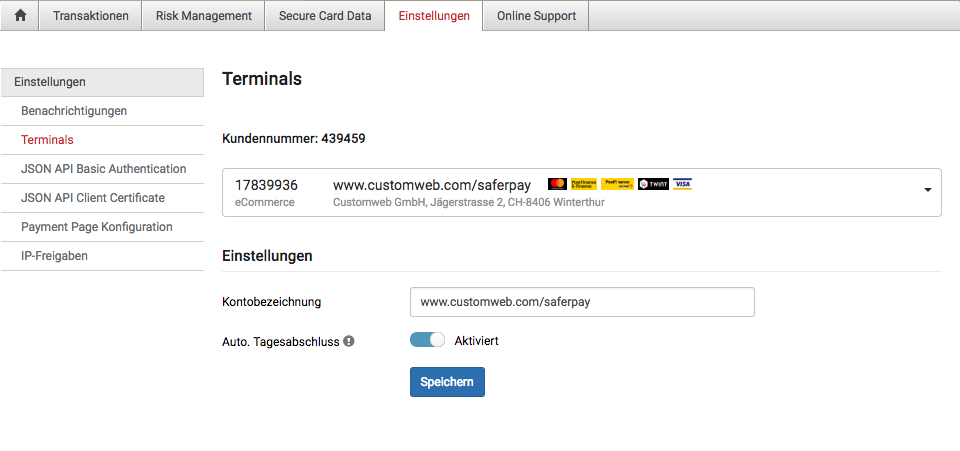

- For the Live Terminal ID you need to go to Settings > Terminals and in the bar at the top you will find an eight digit number. That is your Live Terminal ID. (In the screenshot it's the number 178xxxxx)

2.2Backend Access for the Transaction Administration

The administration and the overview of transactions can be found via the following link:

From here you are able to manage and refund transactions. With the Professional Version you are able to do so directly in your shop. But please note that the status will not be synchronized. Orders that are refunded here will no longer be able to be refunded in you shop.

2.3Creating the JSON-API Access, Terminal ID and Customer ID

For the configuration of the main module with the JSON API you will need a new Customer ID, Terminal ID and the JSON API user and password. The following steps explain where you get this information.

- Go to https://www.saferpay.com and log in with your username and password. On the right hand side you will find a dropdown. Chose Saferpay E-Payment and you will be directed to the backend of MySaferpay. (https://www.saferpay.com/BO/Login/).

- The access data for the JSON API can be created via Administration > JSON API. Here you can chose a password. The user will be generated automatically.

- You will also need a Customer ID. You will find this at the top right. Next to your username there is a number in brackets. ()It looks like this: e402487002). Your Live Customer ID consists of this number. Simply leave away the e and the last three digits and you will receive your Customer ID. It consists of six digi. In the example above your Customer ID would be 402487. (Compare with screenshot further below)

- For the Live Terminal ID you need to go to Transactions > Payment and in the bar at the top you will find an eight digit number. That is your Live Terminal ID. (In the screenshot it's the number 177xxxxx)

2.4Configuration of the Module

Navigate to the main module in your shop. Please fill in the following data into the corresponding sections:

- Enter the JSON USername and Password

- Terminal ID: Go to Transactions > Payment. There you will find a bar at the top right with an eight digit number. This is your Live Terminal ID.

- Customer ID: You will find this at the top right. Next to your username is a number in brackets. It should look like this: (e402487002). Your Live Customer ID consists of this number. You simply need to leave away the e and the last three digits. In the example above your Live Customer ID would be 402487. Optional: You only need to set a password if you have the Professional Version. If you have not received a password you can leave this field blank.

The rest of the settings in the main module concern specific fraud settings to highlight transactions without 3D Secure. The default settings are correct for the most part.

2.5Activating the Payment Methods and Testing

Now you can activate the payment methods in your shop. (More information regarding the configuration possibilities of the payment methods can be found here). You no longer need to use the Saferpay test card for the tests. You can now directly activate the desired payment method.

You no longer need to run tests with the Saferpay test card. For testing you simply need to activate the payment method MasterCard or Visa and use the published in the appendix for tests.

For Billpay there is a specific test procedure. To test Billpay, activate the payment method and switch to Live. In the configurations of the payment method Billpay activate the purchase mode and run the test purchases together with Billpay.

If the tests were successful, you can activate the module by setting the operating mode to live. Starting from now you can receive payments in your shop.

3Module Installation and Update in the PrestaShop Shop

3.1Installation

At this time you should already be in possession of the module. Should this not be the case, you can download the necessary files in your customer account in the sellxed shop (Menu "My Downloads Downloads"). In order to install the module in your shop, please carry out the following steps:

- Download the plugin. The download can be found in your sellxed.com account under "My Downloads".

- Unzip the archive you have just downloaded.

- In the unzipped folder navigate to the folder "files"

- For some shops there are different versions of the plugin provided. If this is the case open the folder which corresponds to your shop version.

- Using your preferred FTP client upload entire content of this folder into the root directory of your shop. For some shops there is a specific folder containing the plugins. If that is the case upload the plugin into this folder. Make sure that the folders aren't replaced but merely merged.

- If you haven't yet done so, log back into your shop.

3.2Updates and Upgrades

You have direct and unlimited access to updates and upgrades during the duration of your support contract. In order to receive constant information about available updates we ask you to subscribe to our RSS feed that we publish for your module.

More information regarding the subscription of this RSS feed can be found under: http://www.sellxed.com/en/updates_upgrades.

We only recommend an update if something doesn't work in your shop, if you want to use new feature or if there is a necessary security update.

3.2.1Update Checklist

We ask you to strictly comply with the checklist below when doing an update:

- Always do a backup for your database and your files in your shop

- Use always a test system to test the update process.

- Wait until all the files are copied to the shop, clear the cache if there is one in your shop and then visit the configuration page of the main module so that the update process will be initialized.

Please test the update procedure first in your test shop. Our support team is able and willing to help you if you experience problems with the update process. However, if you decide to perform the update directly in your live shop there is the possibility of a downtime of the shop of more than two days depending on the availability of our support if you do not want to book our complementary support.

Depending on the version it could be that the database has to be migrated. We recommend you therefore, to perform the updates in times when the shop is not visited too frequently by your customers.

3.2.2Update Instructions

Please always read the update instruction. Those instructions can be found in the changelog. If there are no special remarks, you can proceed by just overwriting the files in your system.

4Module Configuration in the PrestaShop Shop

The configuration consists of two steps. The first step is the configuration of the main module with all the basic settings (cf. Configuration of the Main Module). During the second step you can then carry out individual configurations for each payment method . This allows for full flexibility and perfect adaptation to your processes.

Please create a backup of the main directory of your shop. In case of problems you will then always be able to return your shop to its original state.

We furthermore recommend testing the integration on a test system. Complications may arise with third party modules installed by you. In case of questions, our support is gladly at your disposal.

4.1Configuration of the Main Module

You will find the settings for the module under Modules, in the group Checkout , Saferpay Integration. Install the module and open the configuration mask by clicking Configure. Enter the individual options such as described above in the configuration of the administration interface of Saferpay. You will find information on the individual options directly in the additional texts in the module

If you are using a multishop setup within PrestaShop, you will need to configure the payment plugin in the main shop view first. If you do not configure the settings of the plugin in the main shop view at all, the payment will not work properly. We strongly advise you to configure your main store first before moving on to the configuration of your subshops.

If you are using the standard version of the module, then please do not enter anything into the Saferpay API Password; except if Saferpay has explicitly told you so.

If you are using the professional version of the module, then you require the password. Should you not yet have received it from Saferpay, then please contact the Saferpay support directly.

4.2Configuration of Payment Methods (for PrestaShop 1.6)

After you have installed the main module you can install the corresponding payment methods. To do so you have to install the desired payment methods under Modules in the group of Payments and Gateways. You can save individual settings for each payment method and thereby optimally adapt the payment to your processes. The most central are explained in more detail in this manual.

4.3Configuration of Payment Methods (for PrestaShop 1.7)

After you have installed the main module you can install the corresponding payment methods. To do so you have to install the desired payment methods under Modules > Module Catelog. You can save individual settings for each payment method and thereby optimally adapt the payment to your processes. The most central are explained in more detail in this manual.

4.4Direct Capturing of Transactions

The option "Capture" allows you to specify if you wish to debit payments directly or if you first wish to authorise them and then debit the payment at a later point.

Depending on your acquiring contract, a reservation is only guaranteed for a specific period of time. Should you fail to debit the payment within that period, the authorisation may therefore no longer be guaranteed. Further information on this process can be found below.

It may be that settings saved in the payment modules overwrite settings saved in Saferpay.

4.5Uncertain Status

You can specifically label orders for which the money is not guaranteed to be received. This allows you to manually control the order before shipment.

4.5.1Setting the order state

For each payment method you may select in which state the order should be set to depending on the booking state. This is the initial state of the order.

4.6Optional: Validation

Note: It can be that this option is not visible in your module. In this case just ignore this section.

With the option 'Validation' you can define the moment when the payment method should be made visible to the customer during the checkout process. This setting is relevant for modules where the usage depends on the customer's compliance with specific preconditions. For example, if a solvency check has to be carried out or if the payment method is only available in certain countries. In order for the credit check or address validation to also work with European characters, the charset of the "Blowfish mode" must be set to "UTF-8" for certain PSP settings.

You have the choice between these options:

- Validation before the selection of the payment method: A validation verification is carried out before the customer selects the payment method. If the customer does not fulfill the requirements, the payment method is not displayed

- Validation after selection of the payment method: The verification of the compliance occurs after the selection of the payment method and before the confirmation of the order

- During the authorisation: The validation verification is carried out by Saferpay during the authorisation process. The payment method is displayed in any case

4.6.1Usage of the Integrated Multishop Functionality of PrestaShop

The payment module supports the multishop feature of PrestaShop. No further modifications are necessary. The module automatically recognizes the shop the order belongs to. In order for the multishop functionality to work, it is, however, necessary that the individual sub-shops within PrestaShop have been configured correctly.

5Settings / Configuration of Payment Methods

5.1General Information About the Payment Methods

The plugin contains the most common payment methods. In case a desired payment method is not included per default, please contact us directly.

In order to be able to use a payment method, it must be activated in your account with Saferpay as well as in your shop. Information about the configuration of the payment methods can be found further above.

Below you can find important information for specific payment methods that deviate from the standard process.

5.2Information on Payment Status

For each payment method you can define an initial payment status (status for authorized payments etc.). You hereby define the payment status for each state depending on the processing type of the order (captured, authorized, etc.). It's the initial status which the order assumes. Depending on the mutation carried out by you, the status can change.

Never set the status to Pending Saferpay or any similar pending status which is implemented by the module.

5.2.1Order status "pending" / imminent payment (or similar)

Orders with the status 'pending Saferpay' are pending orders. Orders are set to that status if a customer is redirected in order to pay but hasn't returned successfully or the feedback hasn't reached your shop yet (Customer closed window on the payment page and didn't complete payment). Depending on the payment method these orders will automatically be transformed into cancelled orders and the inventory will be cleared (so long as the Cronjob is activated). How long this takes depends on the characteristics of the payment method and cannot be configured.

If you have a lot of pending orders it usually means that the notifications from your webserver to Saferpay are being blocked. In this case check the settings of your firewall and ask the Hoster to activate the IPs and User Agents of Saferpay.

5.2.2Order status "cancelled"

Orders with the status "cancelled" have either been set to that status automatically due to a timeout, as described above, or have been cancelled directly by the customer.

5.3Billpay by Saferpay

In order to be able to use the payment method BillPay correctly, it is important to carry out the steps below in the correct order.

- Make sure that the payment method has been in your customer account with Saferpay

- Before using BillPay you must complete certain integration tests. In order to do so, switch the Saferpay module to live-mode

- Activate the payment method "Saferpay OpenInvoice" and go to Integration Tests in BillPay and set the BillPay Approval to "Approval Mode". BillPay's employees will then test your shop. Once these tests are complete, switch off the "Approval Mode". The payment method can now be used

6The Module in Action

Below you will find an overview of the most important features in the daily usage of the Saferpay module.

6.1Capturing of Orders

The transaction management between your shop and Saferpay is not synchronized. If you capture payments with Saferpay, the status in the shop will not be updated and a second capturing in the shop is not possible.

In order to be able to capture orders you must make sure that you have set the option 'Capturing' to 'deferred' in the payment method configuration.

Transactions can be captured in different ways. The different options are explained below.

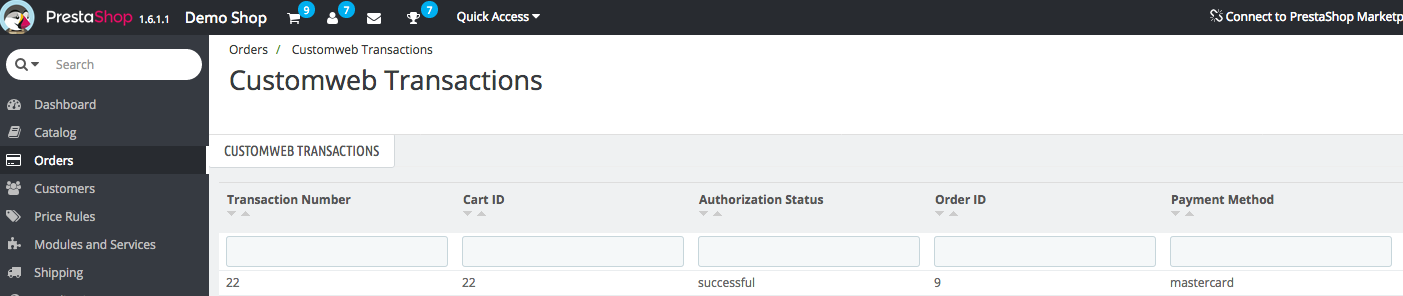

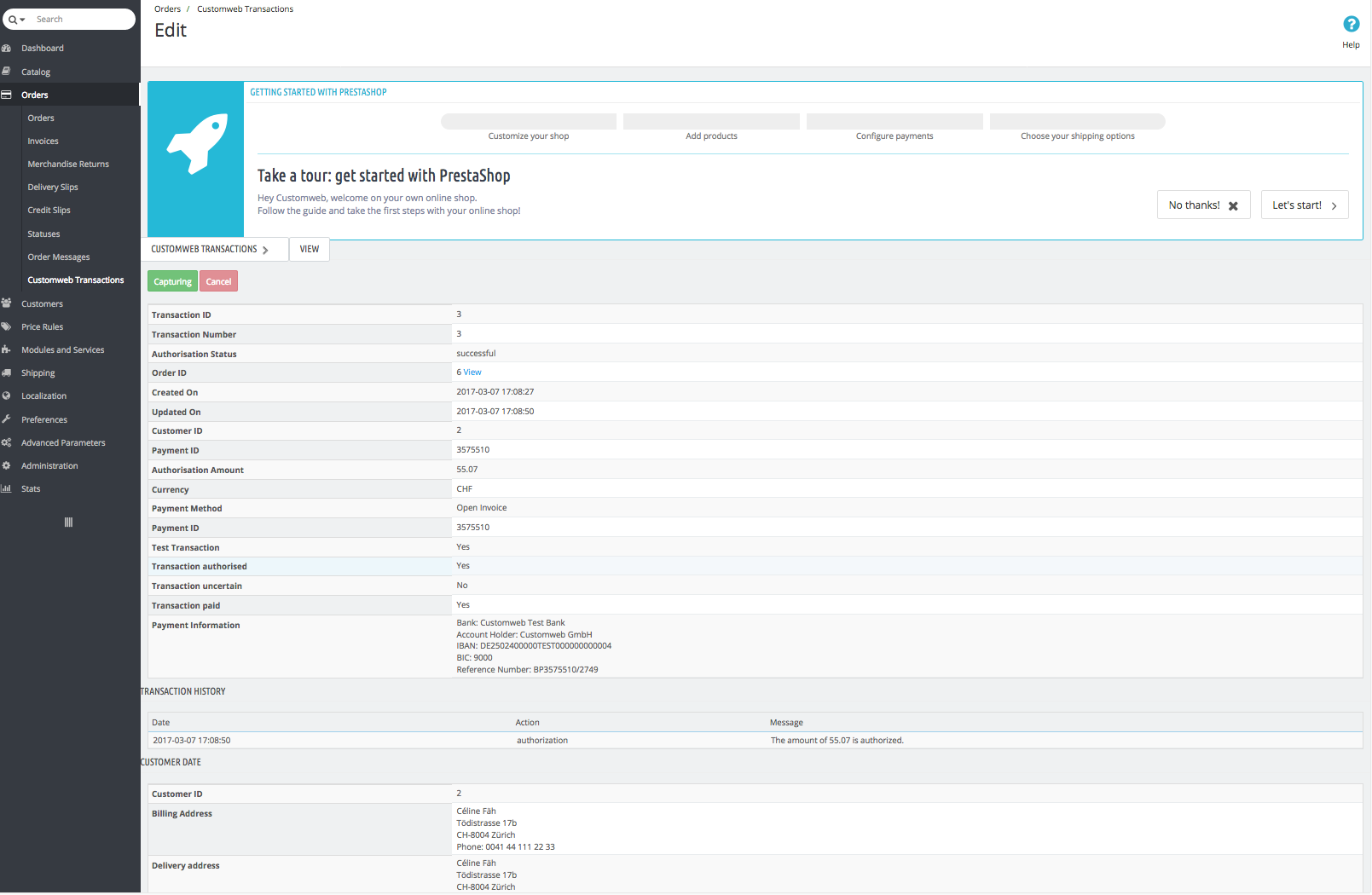

6.1.11. Via Orders > Saferpay Transactions

You can view all transactions in the transaction table under Orders > Saferpay transactions"

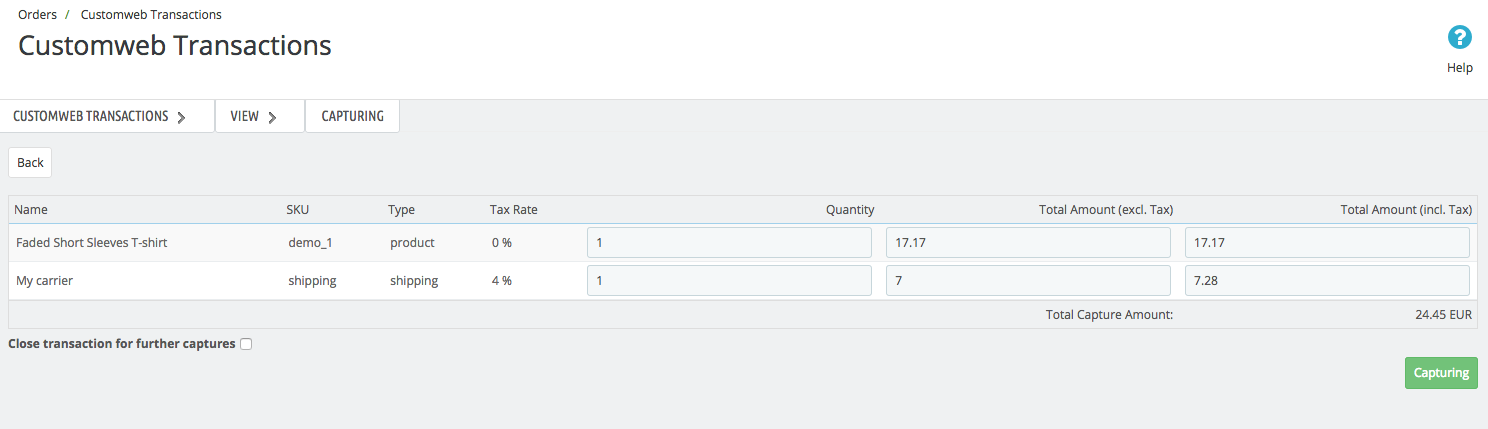

Open the order and then click on the small magnifying glass in den transaction information overview. By clicking Capture button, you get into the following context.

Enter the amount and quantity that you wish to capture from the customer's authorization. By clicking Capture a direct capturing of the order occurs with Saferpay.

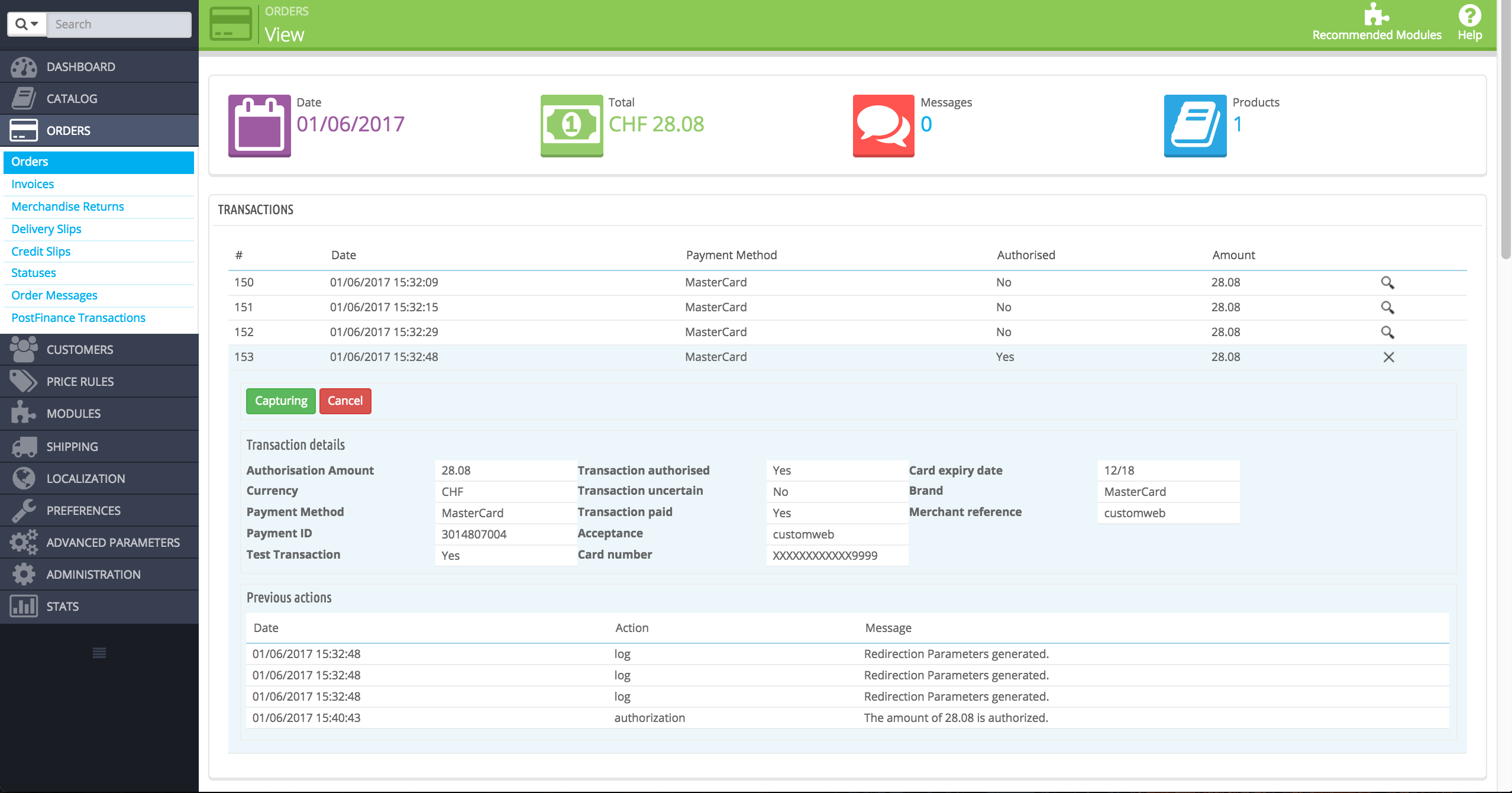

6.1.22. Capture the transaction through the order and the Saferpay transaction tab

Open the order and then click on the small magnifying glass in the Saferpay transactions overview.

A window will then drop down. Enter the amount of your choice that you wish to capture from the customer's authorization. By clicking Capture a direct capturing of the order occurs with Saferpay.

By clicking Capturing button, you get into the following context.

Enter the amount or quantity choice that you wish to capture from the customer's authorization. By clicking Capture a direct capturing of the order occurs with Saferpay.

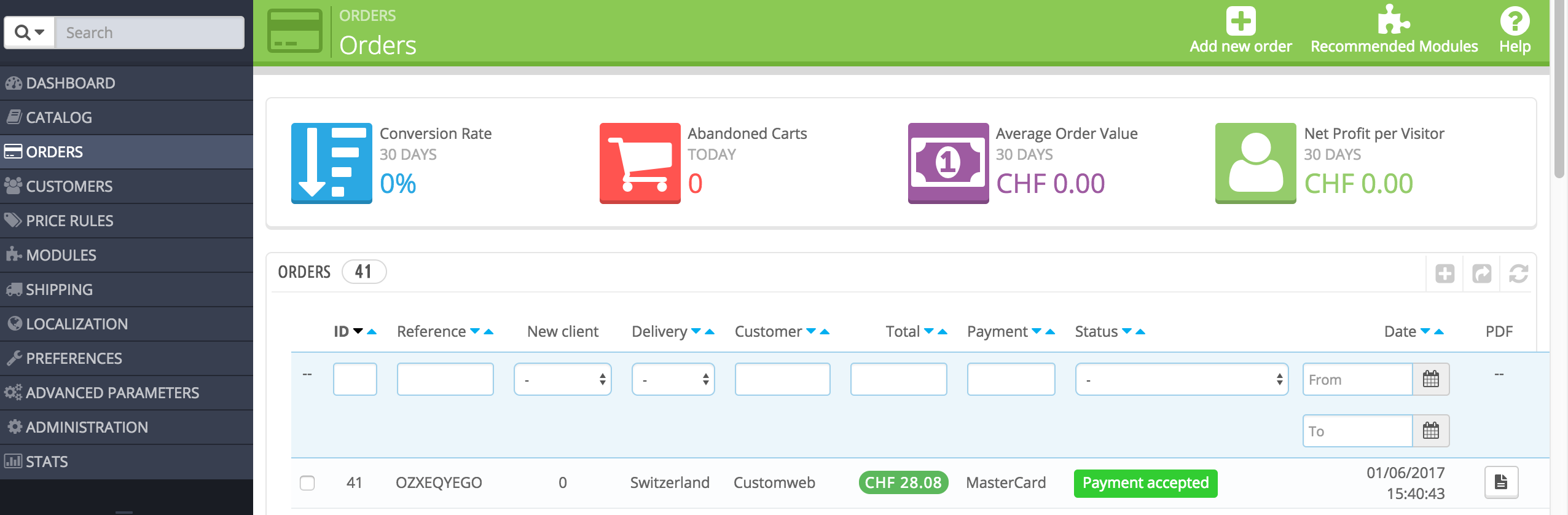

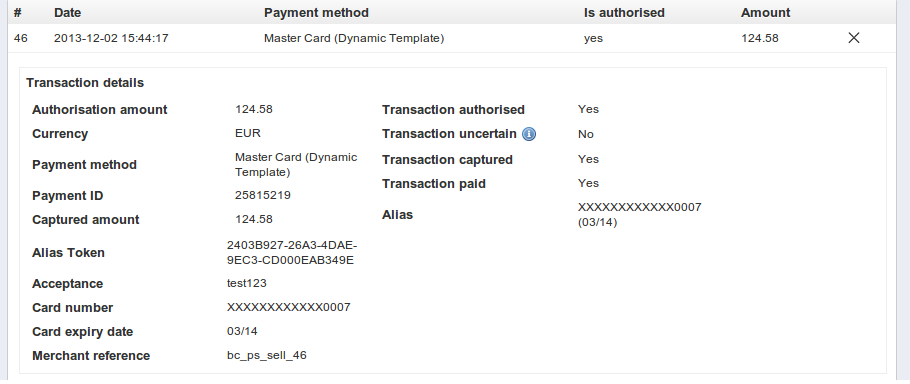

6.2Useful Transaction Information on the Order

In each order, processed via our module, you can find an overview of the most important information about the transaction as well as a transaction history.

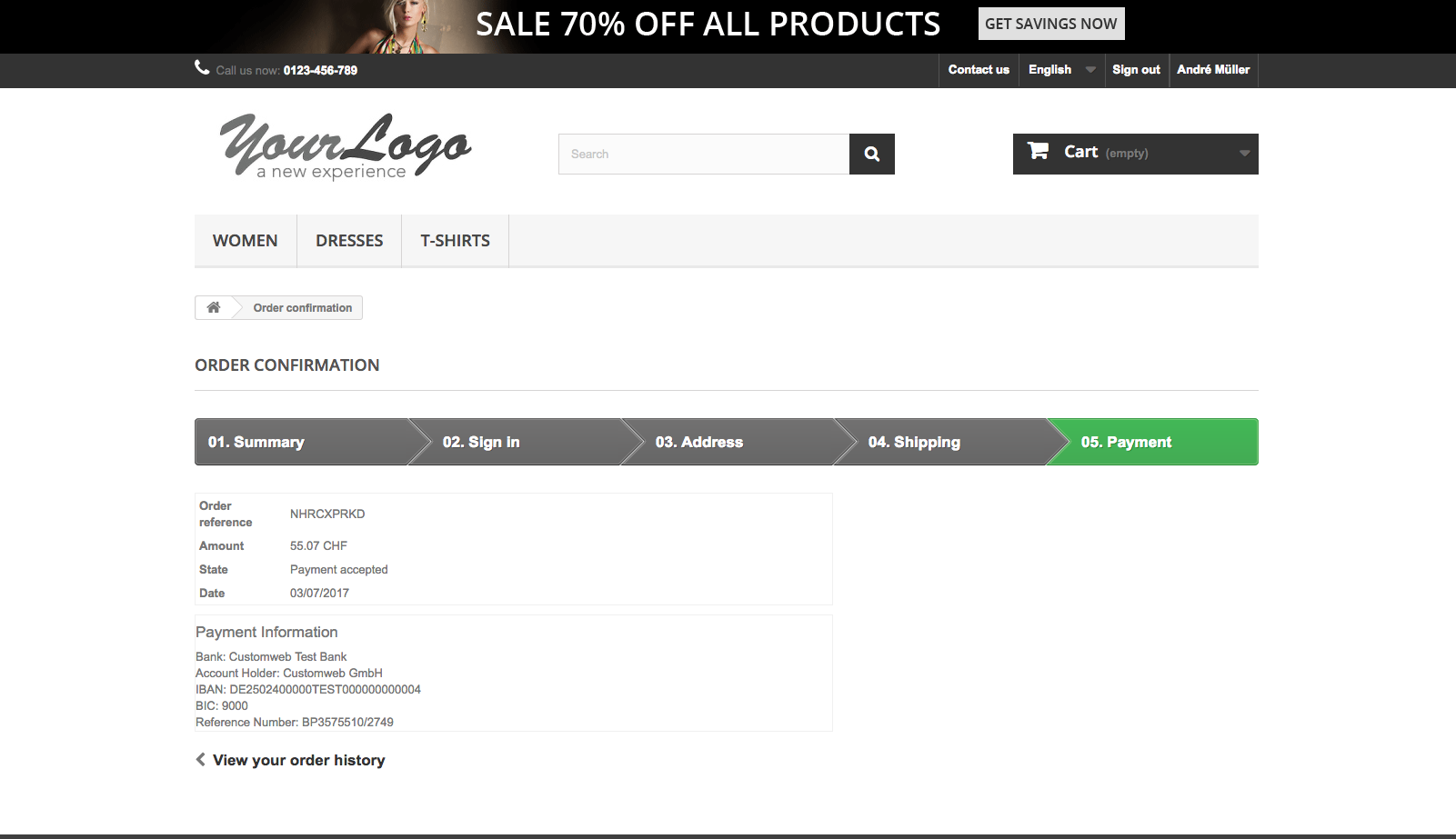

6.3Using Invoice Details of a Processor

In the following context you can view or embed the "payment details" of for example an "Open Invoice" transaction:

6.3.1PrestaShop Order Confirmation (E-Mail)

The "payment information" will be visible in the default "order confirmation e-mail" of PrestaShop.

6.3.2PrestaShop Invoice (PDF)

The "payment information" will be visible in the default PrestaShop-Invoice.

6.3.3PrestaShop-Backend (Transaction details)

You can view the transaction details in PrestaShop under Orders > Saferpay Transactions.

6.3.4PrestaShop Success-Page

6.3.5Payment Information in Email Template

If payment information is required for e.g. prepayment the merchant must manually change the files:

- mails/[language_code]/order_conf.html

- mails/[language_code]/order_conf.txt

The variables are defined as

{code} saferpaycwpayment_information saferpaycw_payment_information saferpaycw_payment_information_txt {/code}

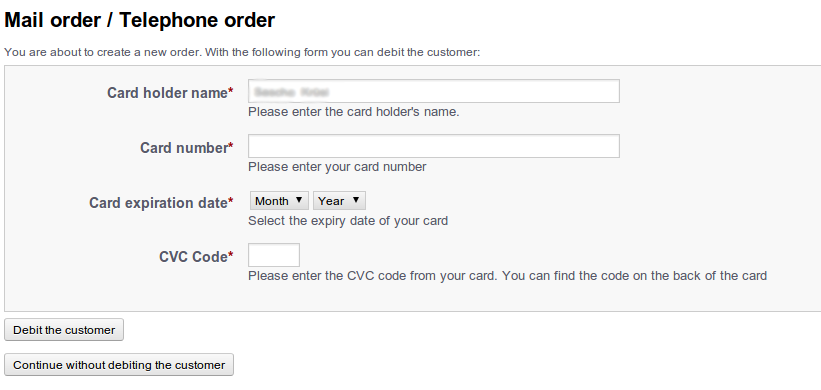

6.4Place Orders in the backend of PrestaShop

With the PrestaShop payment module you can place orders and capture the payment directly in the shop; so called Mail Order / Telephone Order (MOTO).

- Go to the order overview and click on "Create New Order"

- A window will open up. Search for the customer for whom you wish to place an order or manually create a new customer

- Search for the product in question and add it to your cart

- Before clicking Create Order, select the payment method

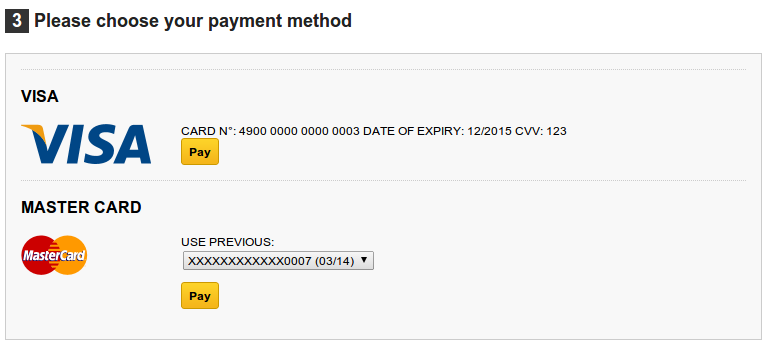

- Depending on the authorization method that you have saved for the selected payment method, you will either be redirected to the Payment Page of Saferpay or the mask for the credit card will appear such as in the image below. Enter the customer's credit card information and click Debit the customer.

6.5Refunds

You can refund already captured transactions and automatically transmit them to Saferpay. In order to to so, open the order. You have two alternatives for refunding the money. Either you use the refund tool or the partial refund process of PrestaShop. Both processes are explained in this passage.

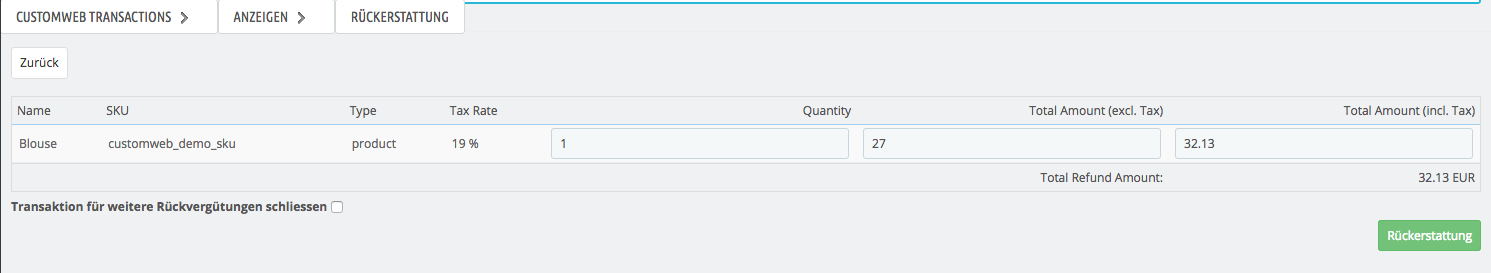

6.5.11. Transactiontable via Orders > Saferpay transactions

You can view all transactions in the transaction table under "Orders > Saferpay transactions"

Open the order and then click on the small magnifying glass in den transaction information overview. By clicking Refund button, you get into the following context.

Just like for the capturing, you open the order and click on the magnifying glass next to the order of your choice. Enter any refund amount of your choice in the field provided for this purpose. By clicking refund the refund request will directly be sent to Saferpay and the specified amount will be credited on the customer's credit card.

Please note that you can't refund more than 100% of the original amount.

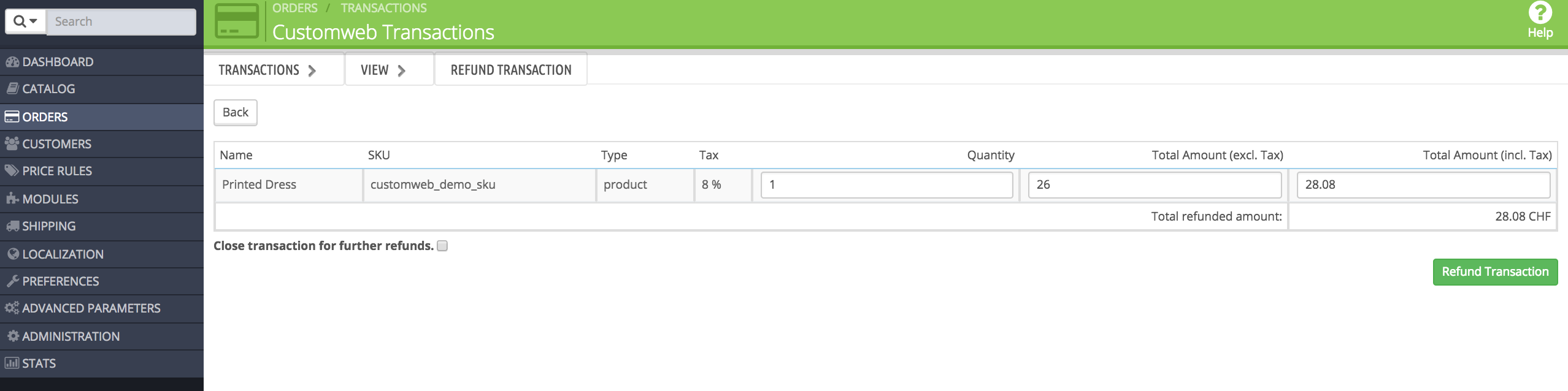

6.5.22. Refund the transaction through the order and the Saferpay transaction tab

Open the order and then click on the small magnifying glass in the Saferpay transactions overview.

By clicking Refund button, you get into the following context.

By clicking Refund button, you get into the following context.

Enter any refund amount of your choice in the field provided for this purpose. By clicking refund the refund request will directly be sent to Saferpay and the specified amount will be credited on the customer's credit card.

Please note that you can't refund more than 100% of the original amount.

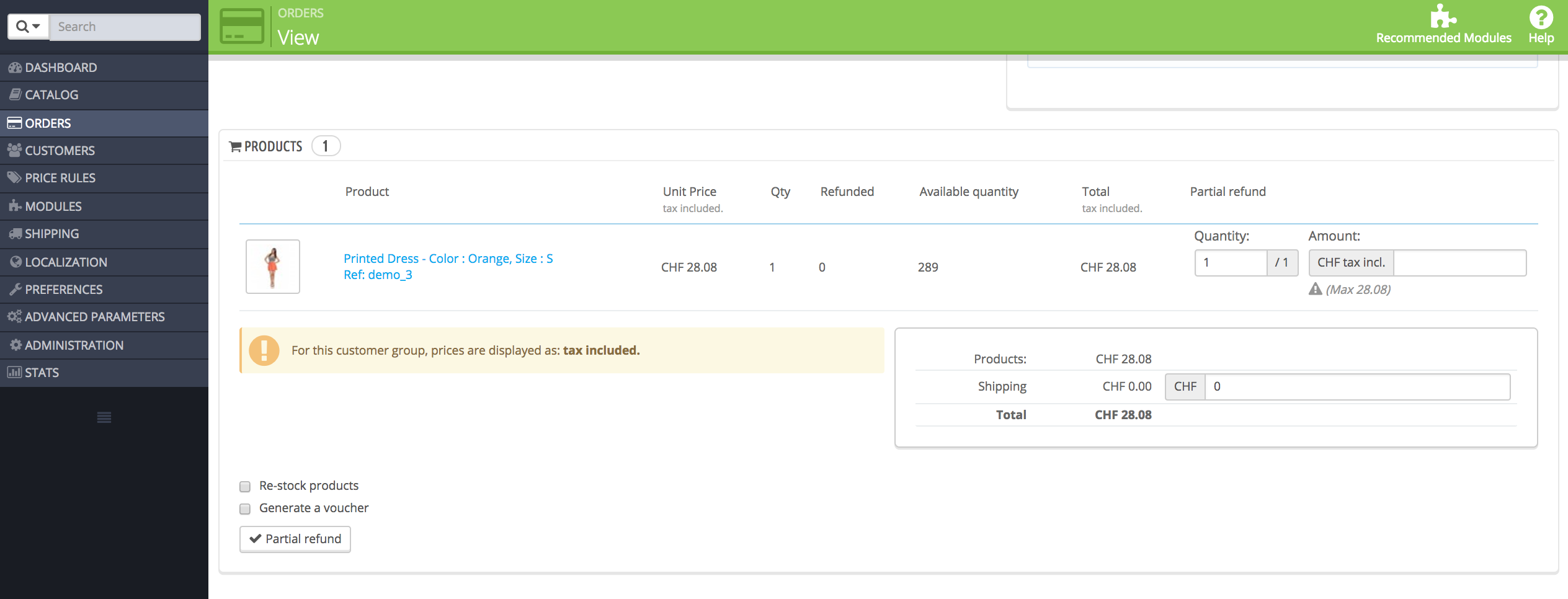

6.5.33. Refund with the PrestaShop internal/default functionality.

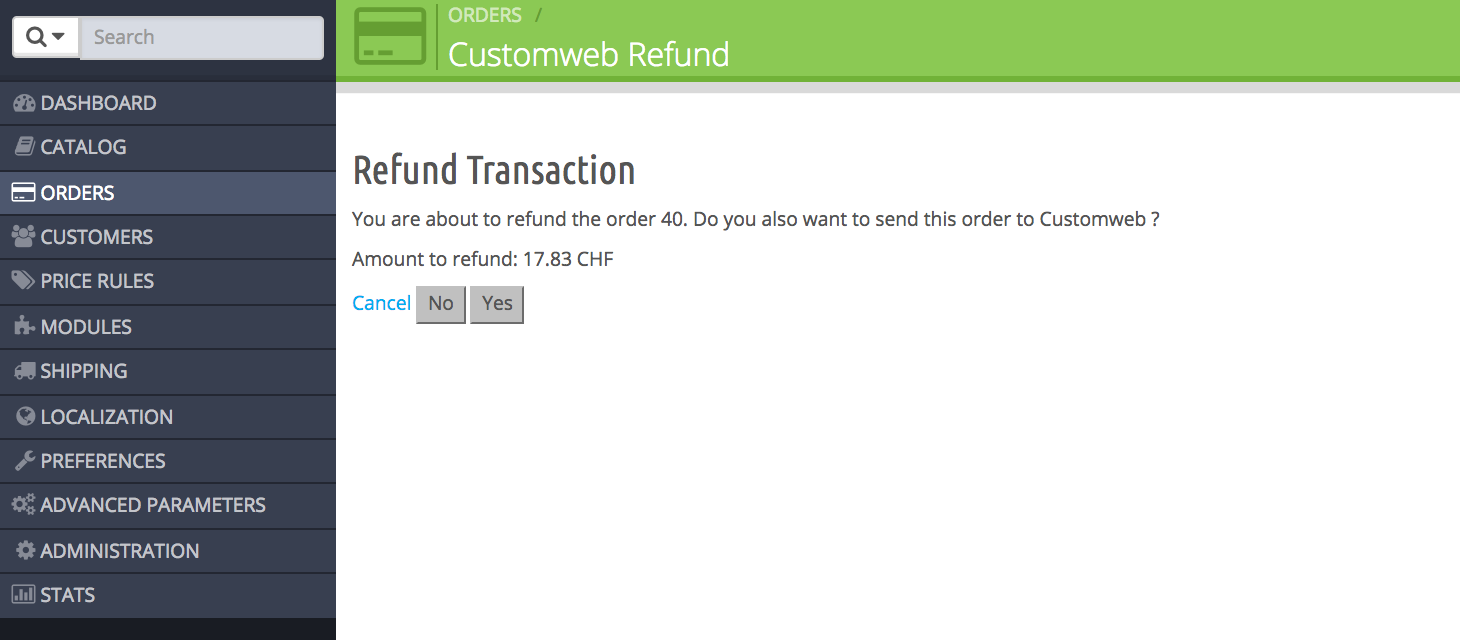

You can carry out refunds with the Partial Refund Process of PrestaShop based on the product quantity. After having opened the order, click on Partial Refund in the top right corner. The browser will scroll down and you can specify the amount of the partial refund. If you wish, you can also directly add the item(s) to the stock. In order to do so, click on the corresponding check-box. By clicking Partial Refund, a new window opens up.

In the following window, click 'Yes' in order to transmit the refund to Saferpay and the specified amount will be credited to the customer's credit card.

Please note that you can't refund more than 100% of the original amount.

Executing a refund will not change the status of the order.

6.6Usage of the Alias Managers / Token Solution

With the Alias Manager, your customers can securely save their credit cards with Saferpay for later purchases. You can enable this by activating the option "Alias Manager" in the configuration of the Payment Method. The customer can then choose from his or her saved credit cards without having to re-enter all the details.

The usage of the Alias Managers requires the activation of the correct option with Saferpay. To do so, please contact the support directly.

6.7One Page Checkout

The checkout of PrestaShop can be modified and reduced to one step. Our module support the standard OnePageCheckout of PrestaShop. No guarantee can be made in regards to the compatibility with third party modules.

You can activate the standard checkout by going to Preferences, Orders. Choose the option 'one-page checkout' in the drop-down menu for Order-process type.

6.8Setting up Cron Job

In order to activate the time-controlled functions of the plugin (such as update service, deleting pending orders, etc.) set up a time-controlled request in your hosting provider backend using the URL which you will now find via Modules > Saferpay in the tab "Extended Information". Invoking it regularly will trigger the actions.

Here we suggest you use a Cron Engine like for example EasyCron. This allows you to open the file ( URL ) with an external service.

7Testing

Before switching from test to live mode it is important that you test the module extensively.

Do not forget to switch the operating mode from test to live after having successfully tested the module.

7.1Test Data

In the following section you can find the test data for the various payment methods:Card number 9010 1000 5200 0004 Expiry Date 12/2020 CVC 123 | Visa - Liability shift: Yes |

Card number 9010 1010 5210 1008 Expiry Date 12/2020 CVC 123 | Visa - Liability shift: No |

Card number 9030 1000 5200 0000 Expiry Date 12/2020 CVC 123 | MasterCard - Liability shift: Yes |

Card number 9030 1010 5210 1004 Expiry Date 12/2020 CVC 123 | MasterCard - Liability shift: No |

Card number 9030 1000 5200 0000 Expiry Date 12/2020 CVC 123 | MasterCard - Liability shift: Yes |

Card number 9030 1010 5210 1004 Expiry Date 12/2020 CVC 123 | MasterCard - Liability shift: No |

Card number 9010 1000 5200 0004 Expiry Date 12/2020 CVC 123 | Visa - Liability shift: Yes |

Card number 9010 1010 5210 1008 Expiry Date 12/2020 CVC 123 | Visa - Liability shift: No |

Card number 9070 1000 5200 0001 Expiry Date 12/2020 CVC 123 | AmericanExpress - Liability shift: Yes |

Card number 9050 1000 5200 0005 Expiry Date 12/2020 CVC 123 | Diners - Liability shift: Yes |

Card number 9060 1000 5200 0003 Expiry Date 12/2020 CVC 123 | JCB |

Card number 9090 1000 5200 0007 Expiry Date 12/2020 CVC 123 | BonusCard |

Card number 9040 1000 5200 0008 Expiry Date 12/2020 CVC 123 | Maestro - Liability shift: Yes |

Card number 9080 1000 5200 0009 Expiry Date 12/2020 CVC 123 | MyOne |

IBAN DE17970000011234567890 | SEPA |

8Errors and their Solutions

You can find detailed information under http://www.sellxed.com/en/faq. Should you not be able to solve your problem with the provided information, please contact us directly under: http://www.sellxed.com/en/support

8.1Orders are not stored in the shop

In case the order is not stored in your shop in spite of you successfully entering the credit card information at ____ paymentServiceProviderName____ , please perform the following steps:

- Make sure that you have tested with the payment method called Saferpay Test Card.

- Make sure that your shop is reachable from an external server without IP restrictions or password prompt.

- It may be that the URL is too long and therefore can not be processed by PHP. In this case, increase the suhosin.get.max_value_length in your PHP configuration.

Shouldn't you be able to solve the problem by performing the above mentioned step, do not hesitate to contact our support team.

8.2Modul Performance

Depending on your server specs it could be that the module results to performance issues in your store. In this case we suggest to do the following:

- Deactivate the PrestaShop Cache. We often saw already better results when the cache was disabled.

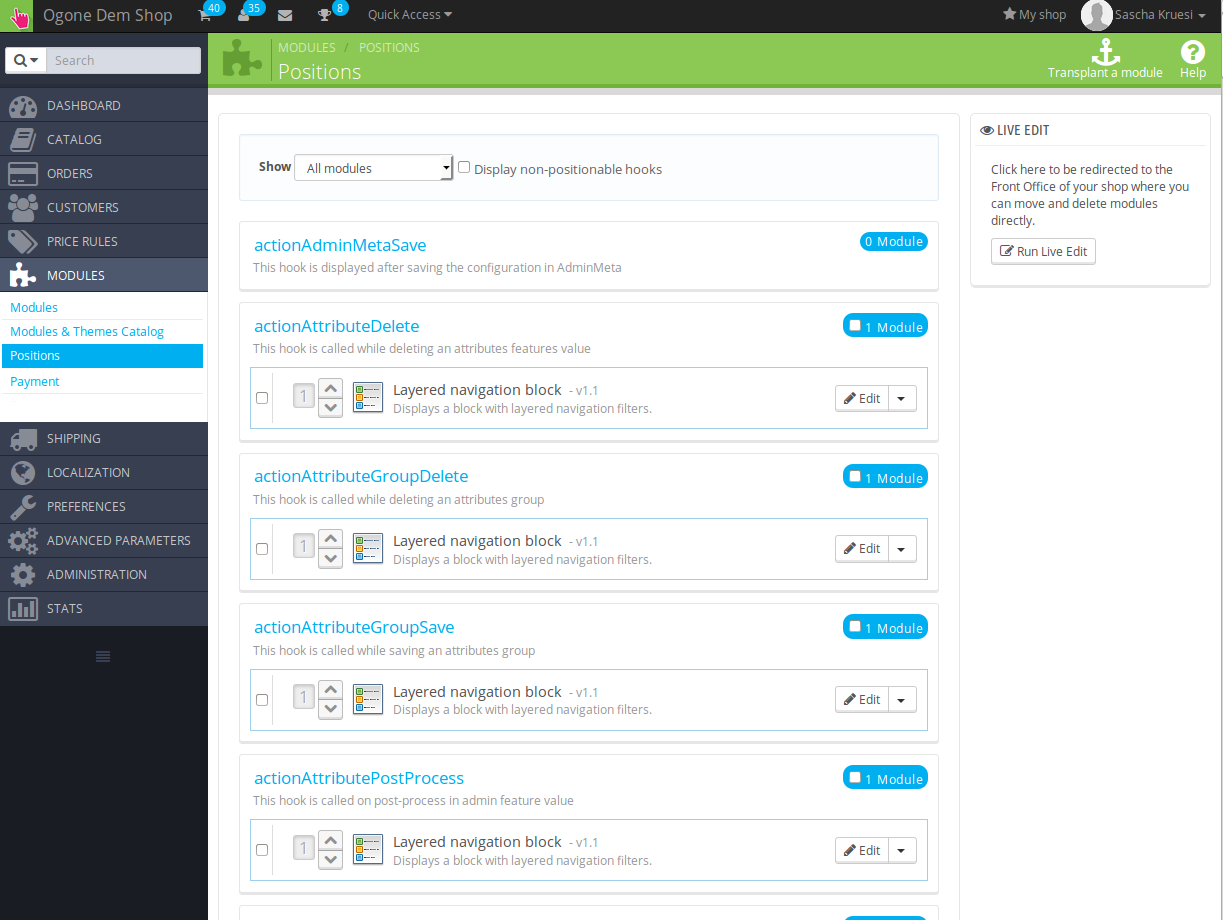

- Deactivate the PrestaShop displayBackOfficeHeader hook. For this go to > Modules > Hooks > and disable the hook Saferpay Integration under the displayBackOfficeHeader Menu.

In case you want to undo the changes above you will need to re-install the base module again.

8.3The Referrer URL appears in my Analytics Tool

When a customer and the notification are redirected via Header Redirection, the Saferpay Referrer URL might appear in your Analytics Tool thus hiding the original traffic source. However, most Analytic Tools are able to minimize this problem.

In case you are using Google Analytics as reporting tool, this step by step guide may help you to exclude the URLs: under bullet point 4.

9Compatibility with Third-Party Plugins

The plugins listed below are compatible with our payment modules and allow you to handle certain tasks in an easier way.

9.1Fee's and discount's within PrestaShop

To configure a Saferpay payment gateways based fee and discount you will need the following 3rd-Party plugin.

9.2Birthday and gender in PrestaShop

For certain payment service providers it is necessary to check the birthday and the gender of a customer. PrestaShop does not check this by default. Information on how to enable those checks can be found here:

10Error Logging

The module will log different unexpected errors or information depending on the configured level. If there is any issue with the module, this log can help identify the cause.

10.1Log Levels

You can configure the log level in the Saferpay settings.

- Off: Nothing is logged. (Default)

- Error: Logs unexpected errors only.

- Info: Logs extended information.

- Debug: Logs information helpful for debugging.

10.2Log Location

In PrestaShop 1.5 the FileLogger is used. The log file is stored in the log folder of your installation. Please make sure the path exists and it is writable by the webserver. (Default Path: {shopRootDirectory}/log/)

In PrestaShop 1.6 and newer the default PrestashopLogger is used and are therefore stored in the database. The log message are visible in the PrestaShop backend under the menu item Advanced Parameters > Logs.

11Advanced Information

This section of the manual is for advanced usage of the module. The content is for advanced users with special requirements. Everything in this section is optional and not required for the daily usage of the module.

11.1Transaction Object

This section describes how to extract information from a transaction, if you need it for further processing. E.g. you require more information of the transaction for further processing an order in your ERP system.

The code snippets in this section assume your script resides in the root folder of the shop with the default shop folder structure.

require(dirname(__FILE__).'/config/config.inc.php');

require_once _PS_ROOT_DIR_.'/modules/saferpaycw/saferpaycw.php'; require_once _PS_ROOT_DIR_.'/modules/saferpaycw/lib/SaferpayCw/Entity/Transaction.php';

$transactionById = SaferpayCw_Entity_Transaction::loadById($transactionId); $transactionObject = $transactionById->getTransactionObject();

$transactionsByOrderId = SaferpayCw_Entity_Transaction::getTransactionsByOrderId($orderId);

foreach($transactionsByOrderId as $transaction){

$transactionObject = $transaction->getTransactionObject();

//Do something with each object

}